Control Payables and Monitor Supplier Transactions with Structured Excel Sheets

Paying suppliers on time is critical to maintaining business credibility and financial discipline. The Accounts Payable Ledger Template offers a ready-made Excel solution to track vendor invoices, manage outstanding dues, and record payments in an organized and efficient way. Designed for practical business use, this spreadsheet helps you take control of your financial obligations and prevent late fees, disputes, or missed payments.

Whether you’re a finance manager, accountant, small business owner, or procurement lead, this template offers clarity and confidence in managing payables.

Check out Accounts Receivables Ledger Excel Format as well.

Overview of Worksheets and Their Functions

This Excel template includes multiple functional worksheets that work together to streamline your payables management:

- Vendor Ledger Sheet: This is the core worksheet where each vendor’s invoices are logged. It includes columns for invoice numbers, issue dates, due dates, amounts, payments made, and balance outstanding. You can use filters to view specific vendors or dates and track pending amounts with ease.

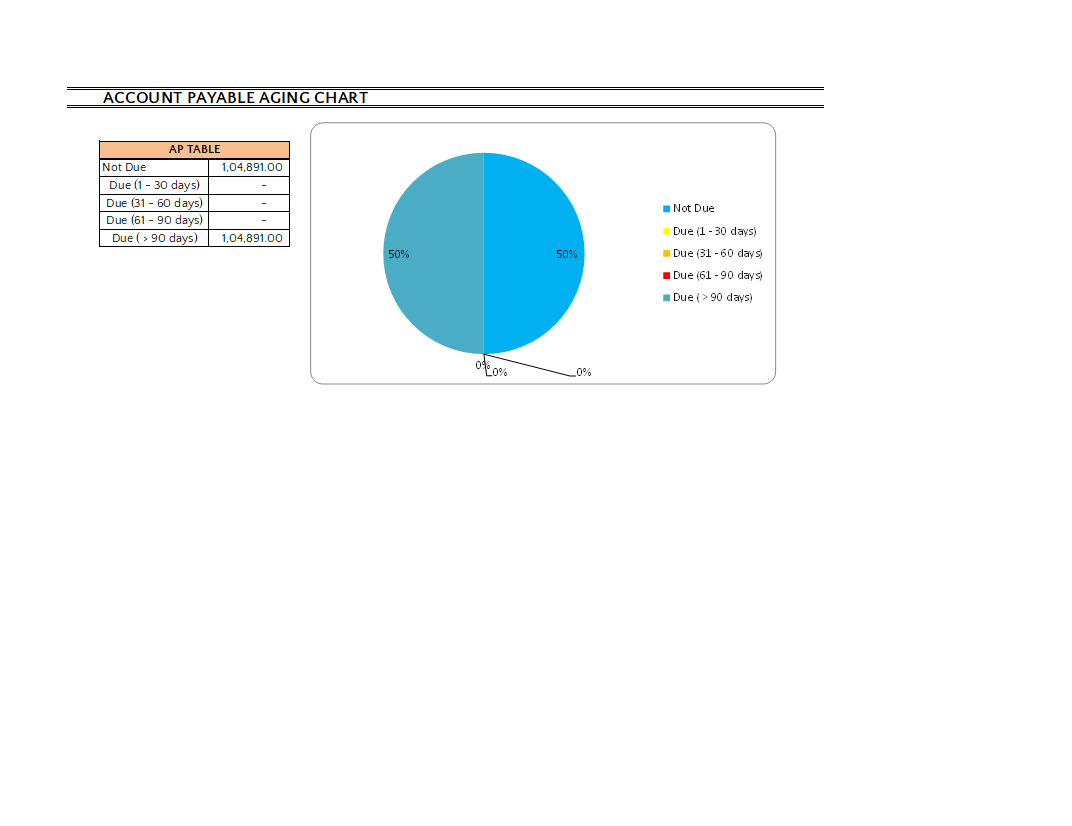

- Summary Dashboard: This sheet provides a high-level overview of total payable amounts, paid bills, and outstanding balances. It auto-updates based on the data entered in the ledger, giving finance teams a snapshot of their liability position at any moment.

- Vendor Master List: Use this sheet to manage vendor information such as names, contact details, payment terms, and categories. It ensures consistency and acts as a reference for validating payee information.

- Payment Tracker: Record individual payments against invoices, including payment method, transaction IDs, and payment dates. This allows easy cross-verification with bank records or audit logs.

Each worksheet plays a vital role in building an accurate and reliable payable system within Excel—without needing expensive accounting software.

Use Cases Across Industries and Teams

The Accounts Payable Ledger Template is versatile and can be applied in many scenarios:

- Small businesses and startups: Maintain manual vendor records and track bills in-house

- Finance departments: Manage centralized payable records across multiple branches or departments

- Retail and distribution: Monitor inventory-related purchases and pending supplier dues

- Construction and contracting: Track material and service invoices tied to project milestones

- Agencies and consultancies: Keep clear payment records for freelancers, vendors, and service providers

- Internal audit and compliance teams: Review payables history and validate payment trails during audit cycles

Because it’s Excel-based, users can customize the sheets as needed, extend them with formulas, or integrate with other financial reports.

Benefits of Using a Payables Ledger in Excel

A structured ledger helps reduce financial risk and operational confusion. With this template, you benefit from:

- Centralized tracking of all payables in one file

- Timely payment alerts through due date visibility

- Better control over vendor relationships and financial health

- Simplified month-end closing and reconciliation

- Easy-to-use layout with pre-built formulas

Therefore, this Excel tool becomes an essential part of any financial workflow.

Download and Start Managing Payables with Confidence

The Accounts Payable Ledger Template gives you the structure, automation, and simplicity needed to manage supplier dues effectively. With editable worksheets, calculated fields, and a clean design, it empowers finance teams and business owners to stay organized.

Download now and streamline your supplier payment tracking in Excel—no software required.

Browse more tools in our Excel Template Library for accounting, invoicing, project planning, and cash flow management.