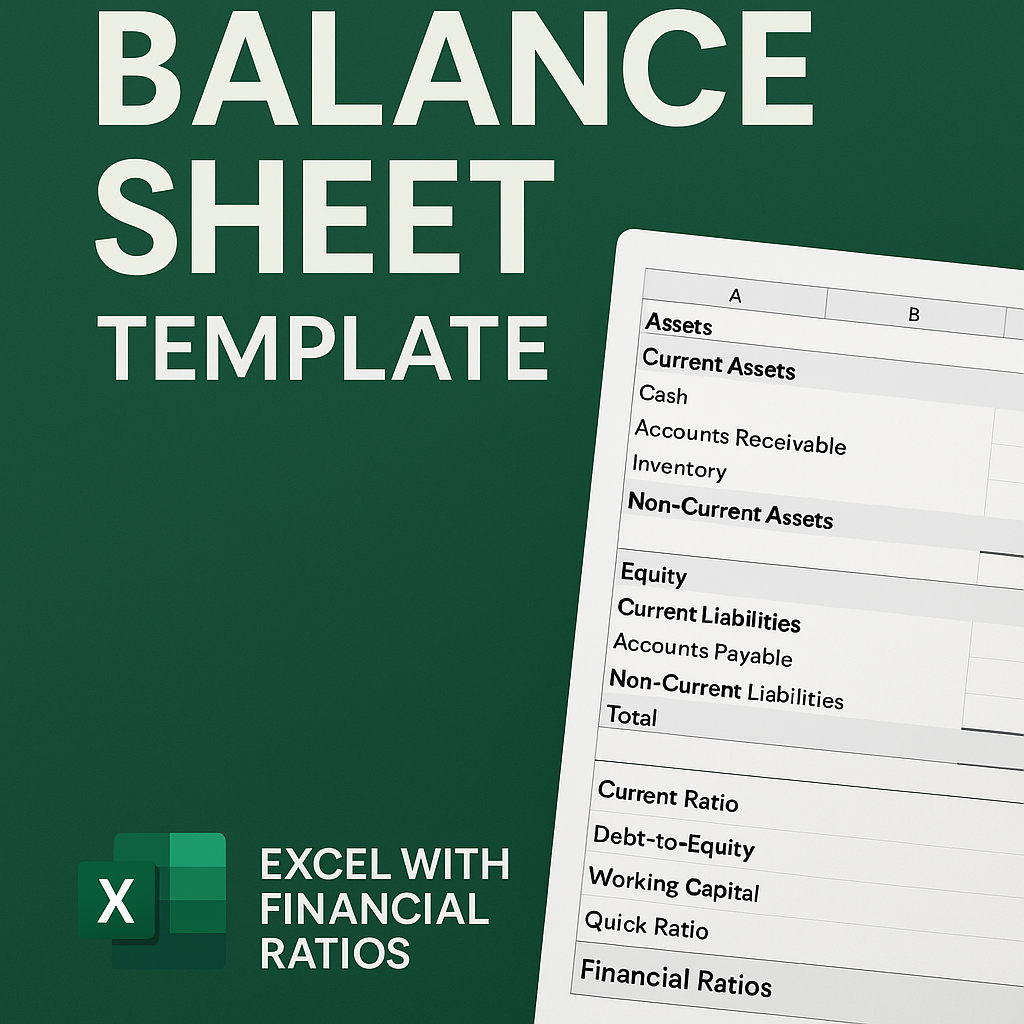

Track Financial Position and Assess Performance with Built-In Ratios

A balance sheet provides a snapshot of your company’s financial position—but when combined with financial ratios, it becomes a powerful analytical tool. The Balance Sheet Template with Financial Ratios is a ready-to-use Excel workbook that not only records assets, liabilities, and equity, but also calculates key financial health metrics automatically.

This is the ideal tool for business owners, accountants, finance students, and consultants who need to evaluate financial stability, liquidity, and operational efficiency.

Worksheet Overview – Structure and Features

The workbook includes a single, multifunctional worksheet titled “Balance Sheet”, designed to consolidate both reporting and analysis:

- Balance Sheet Core Structure

This section records your financial position at a specific point in time, broken down into:

- Current Assets: Cash, accounts receivable, inventory, and other short-term resources

- Non-Current Assets: Property, equipment, and long-term investments

- Current Liabilities: Accounts payable, short-term debt, and accrued expenses

- Non-Current Liabilities: Long-term loans and financial obligations

- Owner’s Equity: Capital contributions and retained earnings

Each line item includes input fields for actual values. Subtotals and totals are auto-calculated using Excel formulas, ensuring that assets always balance with liabilities and equity.

- Financial Ratio Calculations

Just below or alongside the balance sheet, you’ll find built-in ratio indicators that derive insights from the figures above. These include:

- Current Ratio: Measures liquidity by comparing current assets to current liabilities

- Debt-to-Equity Ratio: Evaluates financial leverage and long-term solvency

- Working Capital: Shows the difference between current assets and liabilities

- Asset Turnover or Return on Assets (if included): Highlights operational efficiency

- Quick Ratio (optional): Assesses immediate liquidity, excluding inventory

These ratios automatically update as the balance sheet is filled in, making it easy to assess your financial condition in real time.

Use Cases for Businesses, Advisors, and Students

The Balance Sheet Template with Financial Ratios serves a wide variety of needs:

- Small businesses: Track financial performance without needing accounting software

- Startup founders: Present balance sheet and health metrics to potential investors

- Finance professionals: Use as a base model for client analysis or internal reviews

- Consultants and accountants: Standardize reporting for multiple companies or departments

- Students and educators: Teach accounting concepts and ratio interpretation in a practical format

It’s adaptable, easy to understand, and suited for both beginner and experienced users.

Benefits of Using This Excel Template

Compared to static accounting reports, this template:

- Integrates data entry with real-time performance analysis

- Simplifies ratio calculation and interpretation

- Offers visual clarity and clean formatting

- Requires no software beyond Excel

- Can be reused monthly, quarterly, or annually

With this tool, you’ll not only record your financial position—you’ll understand it.

Download and Evaluate Your Financial Health Instantly

The Balance Sheet Template with Financial Ratios gives you more than a static statement. It empowers you to make informed financial decisions based on liquidity, leverage, and solvency indicators.

Download now and transform your balance sheet into an insight-driven financial dashboard.

Explore more ready-made financial tools in our Excel Template Library for income statements, projections, dashboards, and audits.