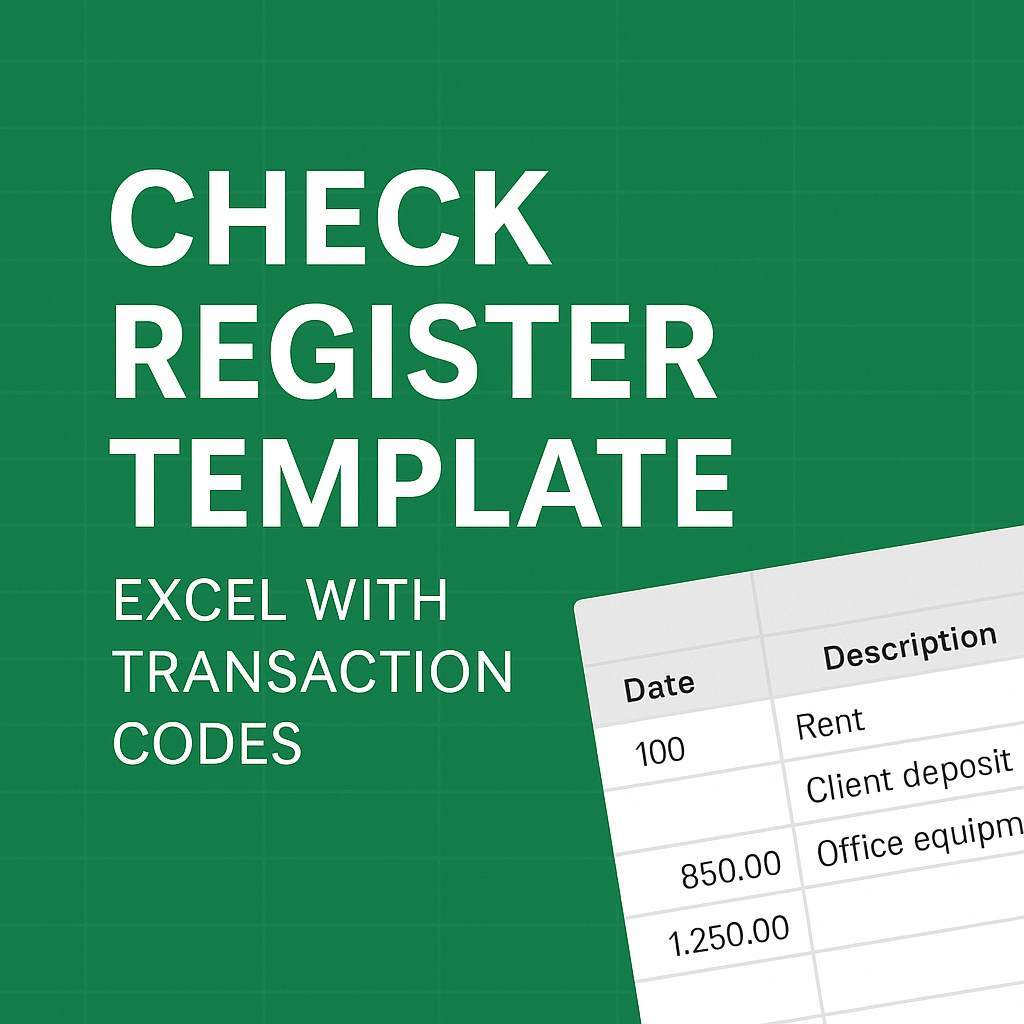

Track Bank Transactions and Categorize Payments with a Simple Excel Log

Managing financial transactions accurately is essential for budgeting, bookkeeping, and reconciling your accounts. The Check Register Template with Transaction Codes is a structured Excel tool that allows individuals and businesses to record checks, deposits, and other banking transactions with clear categorization using transaction codes.

Designed for small business owners, accountants, and home budgeters, this template offers an easy-to-use format for logging every payment and deposit while maintaining financial clarity.

Template Overview – What’s Inside the “Check Register” Worksheet

The workbook includes a single, multifunctional worksheet titled “Check Register”, which acts as a comprehensive ledger for tracking your cash flow.

- Transaction Entry Table

Users can log each financial transaction using predefined columns such as:

- Date: When the transaction occurred

- Check Number: For tracking specific check payments

- Description: Brief explanation of the transaction (e.g., rent payment, client deposit)

- Payment or Deposit: Enter the amount paid or received

- Balance: Automatically updated running total after each entry

This layout provides a real-time view of your account balance, making it ideal for tracking bank statements.

- Transaction Codes

One of the key features of this template is the Transaction Code column. These codes allow users to classify each transaction quickly. For example:

- 100: Rent or lease payments

- 200: Payroll and wages

- 300: Utilities

- 400: Office supplies

- 500: Client payments

- 999: Miscellaneous

These codes can be customized to match your accounting or tax filing needs. Using consistent transaction codes helps simplify categorization, reporting, and audits.

- Auto-Calculated Running Balance

As users enter each payment or deposit, the template updates the account balance line-by-line. This gives immediate visibility into available funds and helps detect discrepancies early.

- Printable and Shareable Format

The design is clean, printable, and shareable with your accountant or bookkeeper. It’s also editable and can be duplicated monthly or quarterly to maintain a continuous financial record.

Use Cases for Personal and Business Finance

The Check Register Template can be used by:

- Small business owners: Track outgoing payments and customer deposits

- Freelancers and contractors: Maintain detailed records of income and project expenses

- Finance departments: Reconcile checks and payments with transaction categories

- Personal users: Monitor household spending and avoid overdrafts

- Nonprofits: Keep transparent records for donations and disbursements

The template is especially helpful when you want better control over check usage and categorized spending.

Benefits of Using This Excel Check Register Template

Compared to a paper ledger or basic Excel sheet, this enhanced template offers:

- Coded categorization for easy tracking and sorting

- Live balance calculation to avoid overspending

- Customizable transaction types for various needs

- Simplicity and clarity for both individual and business use

- Compatibility with printable reports and financial reviews

It gives you clarity over every cent flowing in or out of your account.

Download and Simplify Your Transaction Tracking

The Check Register with Transaction Codes makes financial recordkeeping more organized, accurate, and useful. With clear categorization and auto-updating balances, you’ll always know where your money is going.

Download now and start tracking your checkbook or business account with precision.

Explore more Excel finance tools in our Template Library including income trackers, budgeting tools, and ledger templates.